2025 FOMC Schedule A Comprehensive Overview

With great pleasure, we will explore the intriguing topic related to 2025 FOMC Schedule: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

The Federal Open Market Committee (FOMC) is a crucial body within the Federal Reserve System, responsible for setting interest rates and conducting open market operations to influence the monetary policy of the United States. The FOMC typically meets eight times a year, and its schedule is closely monitored by investors, economists, and policymakers alike. This article provides a comprehensive overview of the 2025 FOMC schedule, highlighting key dates and potential implications for the financial markets.

The FOMC holds regular meetings approximately every six weeks, typically on a Tuesday and Wednesday. During these meetings, the committee discusses economic and financial conditions, assesses the risks to the economy, and makes decisions regarding interest rates and monetary policy. The 2025 FOMC schedule includes the following regular meetings:

In addition to regular meetings, the FOMC may also hold special meetings if necessary. Special meetings are typically called in response to significant economic events or market developments that warrant immediate attention. The 2025 FOMC schedule does not currently include any special meetings, but they may be scheduled if circumstances require.

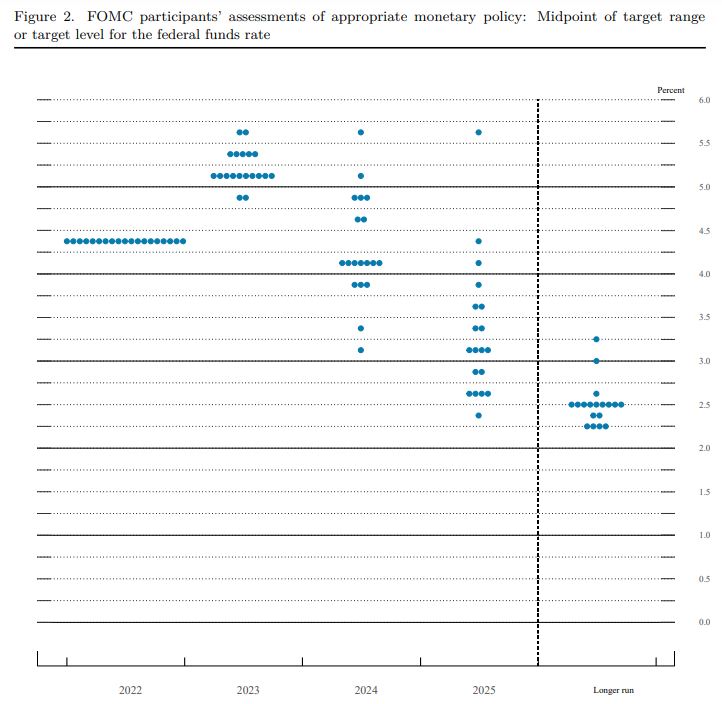

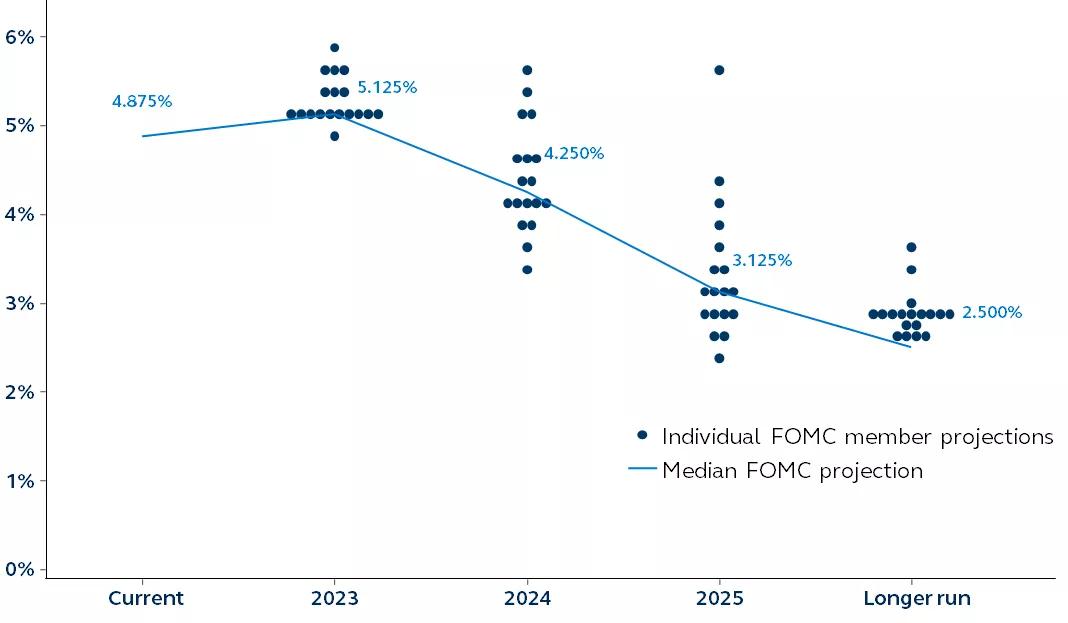

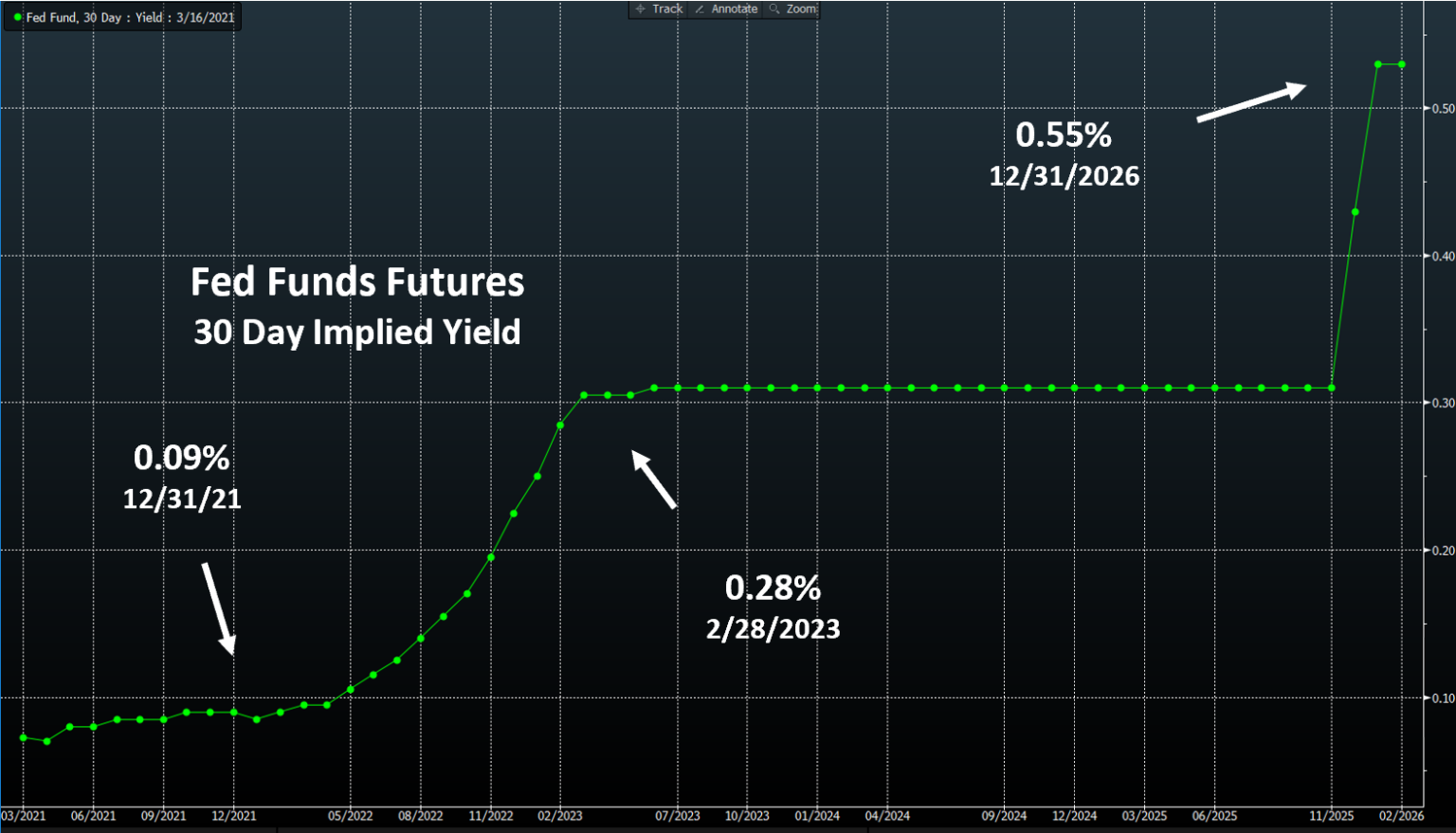

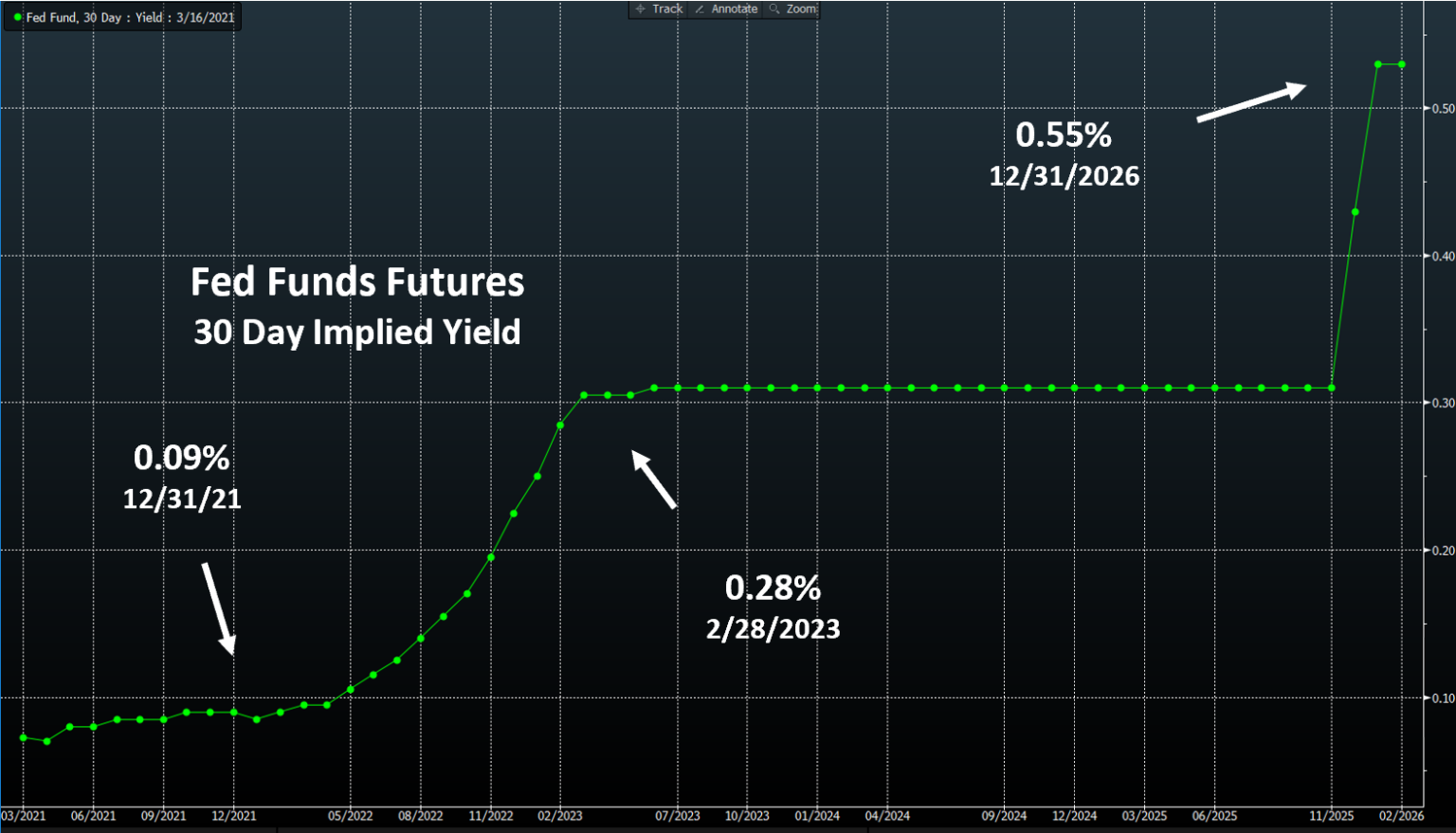

One of the most important aspects of the FOMC schedule is the announcement of interest rate decisions. The FOMC sets the target range for the federal funds rate, which is the interest rate charged on overnight loans between banks. Interest rate decisions are closely watched by the markets, as they can have a significant impact on economic growth, inflation, and asset prices.

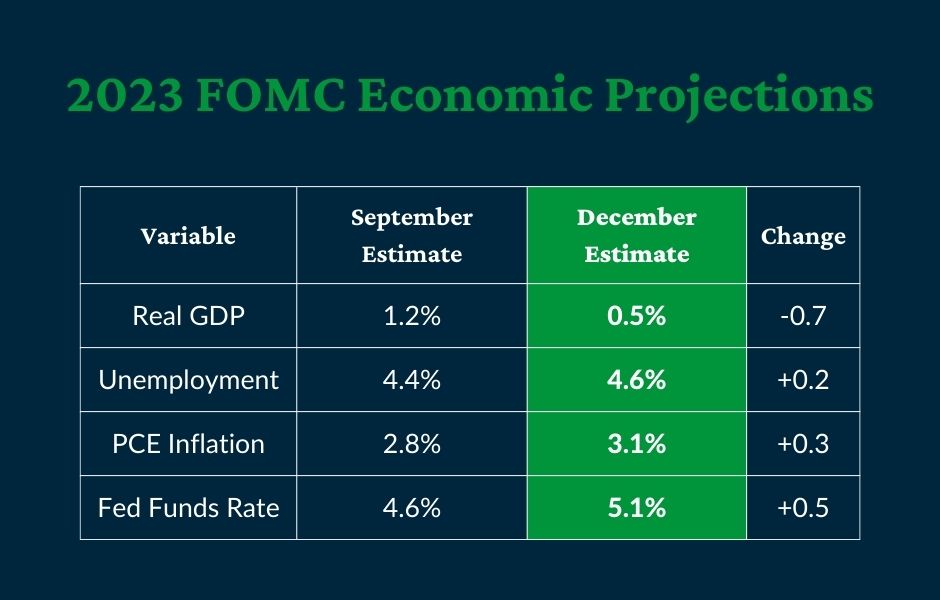

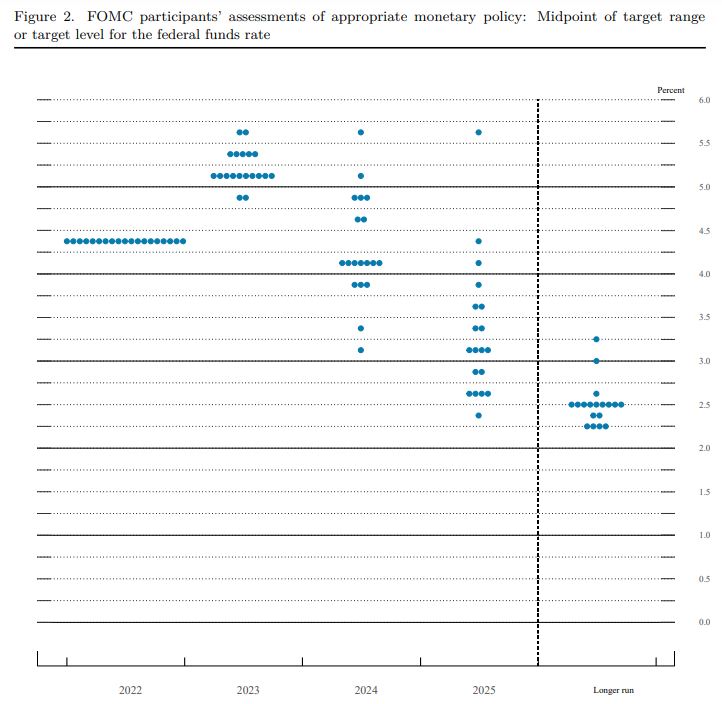

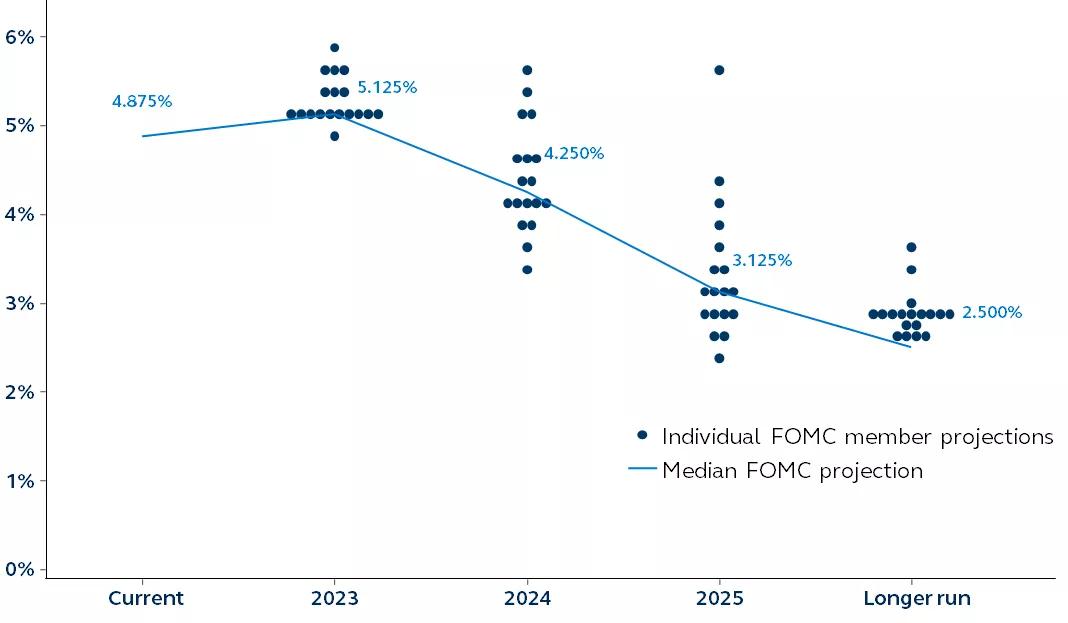

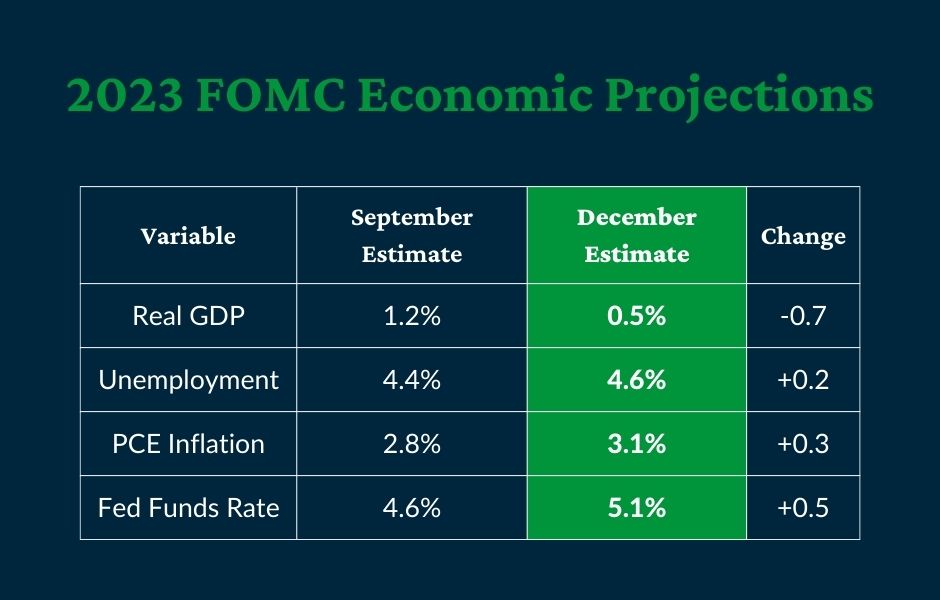

Following each meeting, the FOMC releases a monetary policy statement that provides an update on the committee’s assessment of economic conditions and its decision on interest rates. The monetary policy statement also includes projections for economic growth, inflation, and unemployment. These projections are closely scrutinized by analysts and investors for insights into the FOMC’s future policy stance.

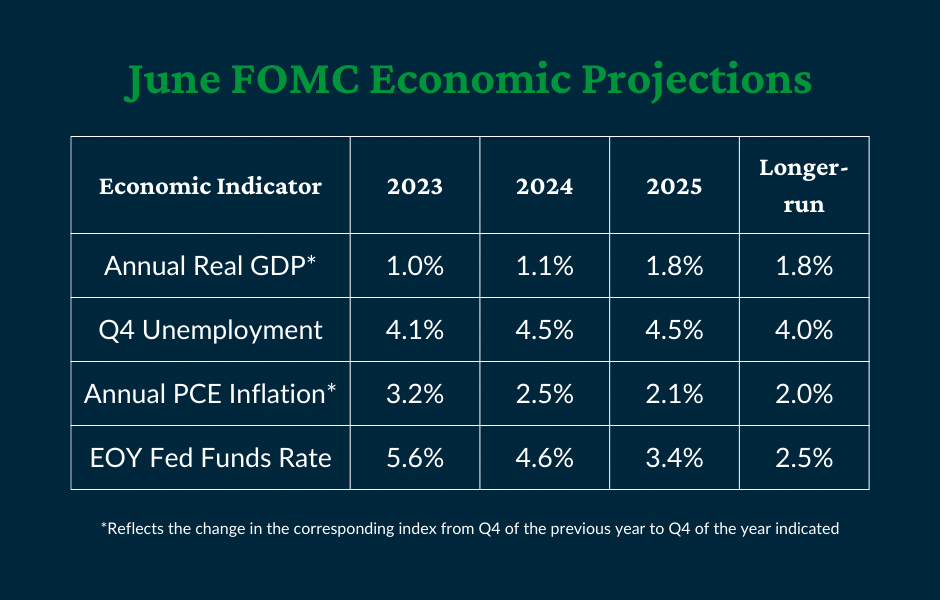

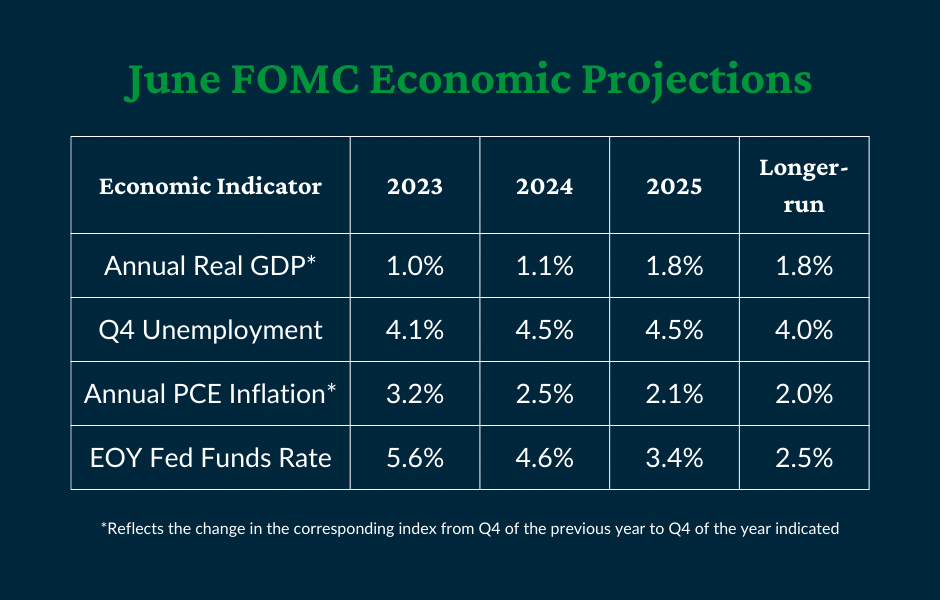

In addition to monetary policy statements, the FOMC also releases economic and financial projections at each meeting. These projections provide a detailed forecast of the committee’s expectations for the economy over the next two years. The projections include estimates for real GDP growth, inflation, unemployment, and other key economic indicators.

The FOMC schedule is closely watched by the financial markets, as it can provide valuable insights into the central bank’s thinking and potential policy actions. Interest rate decisions, monetary policy statements, and economic projections can all have a significant impact on asset prices, exchange rates, and economic activity.

The 2025 economic outlook is uncertain, with various factors influencing the trajectory of the economy. The ongoing COVID-19 pandemic, geopolitical tensions, and global supply chain disruptions continue to pose risks to economic growth. Inflationary pressures remain elevated, although they are expected to moderate over time. The FOMC will closely monitor these developments and adjust its monetary policy stance as necessary to achieve its dual mandate of price stability and maximum employment.

The 2025 FOMC schedule provides a roadmap for key monetary policy decisions throughout the year. Regular meetings, interest rate announcements, and monetary policy statements will be closely watched by investors, economists, and policymakers alike. The FOMC’s decisions will have a significant impact on the financial markets and the overall economic outlook. As the year progresses, the FOMC will continue to navigate a complex and evolving economic landscape, balancing the need to control inflation with the potential risks to economic growth.

Thus, we hope this article has provided valuable insights into 2025 FOMC Schedule: A Comprehensive Overview. We thank you for taking the time to read this article. See you in our next article!